org, agrees."Younger motorists are statistically more probable to be associated with a mishap. Teenager motorists are considered high-risk by insurance providers due to the fact that beginner vehicle drivers are dangerous behind the wheel. Higher costs are passed on to policyholders as an outcome of the better danger," she says (automobile).Car insurance for young vehicle drivers is costly, as you'll see in the table below, but you can still conserve by placing the teen on your auto insurance coverage instead of obtaining him or her their very own car insurance plan, and also by amassing all the price cuts you can for young drivers (auto).

"Historical insurance policy data reveal that teen kid chauffeurs are most likely to be involved in accidents as well as Drunk drivings as well as pay much less interest to the customary practices. liability."Katie Sopko, an insurance agent/agency supervisor with An And also Insurance in Greenville, South Carolina, claims stats reveal male drivers trigger roughly 6. credit. 1 million mishaps annually versus 4.

accident insurance auto credit score

accident insurance auto credit score

insurance companies cheaper auto insurance insurance company cheapest

insurance companies cheaper auto insurance insurance company cheapest

Getting a bargain on teen auto insurance policy, Our moms and dad overview to guaranteeing a teenager supplies even more detail, but below we'll use the must-know actions to take for keeping teen driver rates as low as feasible. Search, The more you spend for insurance, the extra likely you can save money.

You can contrast vehicle insurance coverage estimates online or by calling several representatives (credit). It's an excellent suggestion to inspect quotes for various other vehicle insurer when you include a teen driver to your plan. Including a teen can double your prices, so make certain you get the very best bargain. Comparing quotes is your best shot at conserving money, and the benefit for a few minutes of job could be hundreds and even countless dollars.

5 Simple Techniques For How Much Does Insurance Cost For A 16 Year Old

car insured cheap insurance cheap auto insurance insure

car insured cheap insurance cheap auto insurance insure

In general,. You might also be able to obtain a multi-driver discount rate once you add your teenager to your policy."If your kid is currently in college or taking university courses, a lot of carriers will certainly supply a trainee discount. risks. As well as if your kid took a defensive course prior to obtaining their license, a lot of companies will provide a discount rate for this too," Sopko notes. cheaper.

"I suggest covering the teenager for obligation just till they are about two decades old, which is the age when coverage rates often tend ahead down - insurance companies."Do I have to add my teenager to my vehicle insurance coverage? State regulations differ, so it's recommended that you constantly inform your auto Additional resources insurance provider that you have a young motorist, yet in basic: All licensed chauffeurs in a house demand to be included in a plan (low-cost auto insurance).

Some states enable an accredited teenager to be left out from your plan, yet you have to examine to see if your insurance coverage business additionally permits it-- few do (vehicle insurance). Some states allow auto insurance coverage firms to need you to note teenagers with driving authorizations-- so those who are not yet also certified-- on your insurance plan.

A lot of states will not enable a teenager to title a vehicle in his own name. Also if your state has no age constraints on labeling a car, teen drivers under age 18 are unlikely to find insurance coverage by themselves. It's a contract, and also teenagers are not old enough to sign one. insurers.

Cheapest Car Insurance For 16-year-olds - Insurify Things To Know Before You Get This

Remote trainee, Young person vehicle drivers who live on campus for college or attend institution in one more state and leave their parking lot at the household house may be qualified for a distant pupil discount rate, claims Yoshizawa. car."Several insurance firms give discount rates for trainees that live 100 miles away or much more. Integrated with an excellent student price cut, this might provide significant cost savings for families when it concerns vehicle insurance coverage," Yoshizawa includes (cheap insurance).

Purchasing a new vehicle can additionally imply cash money incentives and also discounts or unique leasing rates they can conserve cash," Yoshizawa explains."Note that a lot of car insurance coverage plans will enable the team to drive any vehicle in the family.

vehicle insurance car insured credit risks

vehicle insurance car insured credit risks

affordable auto insurance car insurance business insurance credit

affordable auto insurance car insurance business insurance credit

We found that the typical price to guarantee a 16-year-old is $813 monthly for full coverage, based on our analysis of hundreds of rates throughout nine states. Generally, 16-year-old boys pay $63 more each month contrasted to girls. We found that Erie has the most inexpensive vehicle insurance coverage for 16-year-old motorists at $311 monthly for full insurance coverage, based upon our evaluation of thousands of prices throughout 9 states. business insurance.

Expense of vehicle insurance for 16-year-olds compared to other ages Insuring a 16-year-old chauffeur can be really pricey. The expense to guarantee a 16-year-old motorist is even more than double the typical expense to insure a 25-year-old - vans. A 16-year-old can anticipate their insurance coverage expense to reduce by approximately 9% when they turn 17 (laws).

Our Should You Add Your Teen Driver To Your Car Insurance ... Ideas

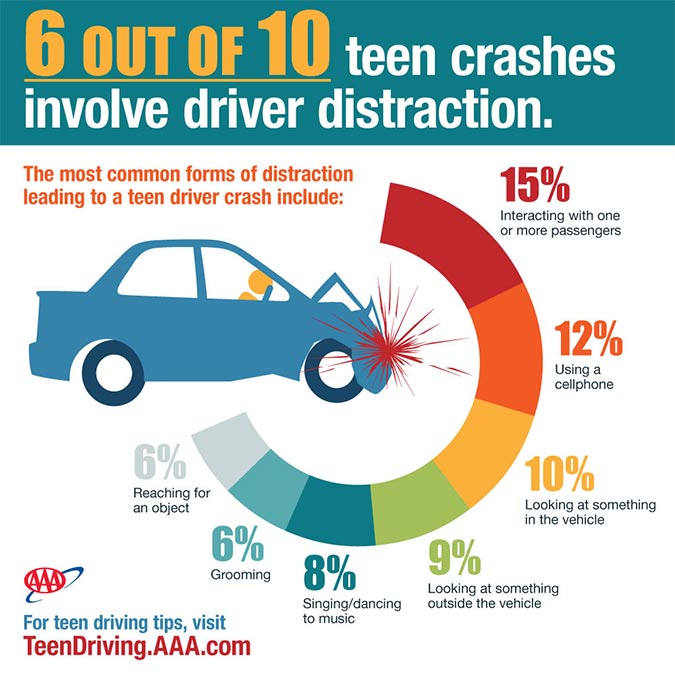

This is since young male vehicle drivers often tend to display contrasted to young women vehicle drivers, such as speeding or driving drunk - cheap auto insurance. 17$768$70518$647$586 Why is cars and truck insurance so costly for 16-year-olds? Cars and truck insurance policy is a lot extra expensive for 16-year-old vehicle drivers due to the fact that they are more probable to enter accidents than older vehicle drivers.

Prices for 16-year-olds are additionally higher because insurer do not have existing data to base their models on - laws. Vehicle insurance policy rates are partially based upon your driving background, as a person that has driven accident-free for numerous years will pay much less for insurance coverage than someone who has actually caused a number of car crashes - vehicle.

This causes higher costs for every teenage vehicle driver, no issue just how mindful they are (cheaper cars). The least expensive car insurance company for 16-year-olds by state Geico as well as State Ranch are frequently the cheapest insurance companies, as both firms are the least expensive option in three states. Below are the most affordable insurance provider for a 16-year-old in our nine sample states.