For an 18-year-old taking out a policy, they can expect it to be about $688 per month or $8,250 yearly. They pay about $1,977 per year.

In Brampton it is about $2,400 annually, which is the greatest in the province. Cities such as Kingston as well as Belleville typical concerning $1,000 per year.

Some various other aspects that influence rates for car insurance coverage Numerous things have a direct influence on the price of vehicle insurance policy. Some you have control over (what you drive, driving history) as well as others you don't (insurance policy market aspects).

There are also private considerations you can not manage, such as your age and also gender. Will the rate of insurance go down for vehicle drivers? Even though the Ontario provincial federal government has actually made pledges to obtain insurance coverage under control, the annual average costs are still on the rise.

People are starting to get a break to some level - cheap. In terms of age, you can anticipate to begin seeing lower costs when you turn 25.

Car Insurance Prices - State Farm® for Beginners

In this post, Component 1 goes over the value of knowing your month-to-month fee, Component 2 shows you just how to determine month-to-month costs, as well as Component 3 discusses how to contrast the results (car insurance). Part 1 of 3: The importance of recognizing your regular monthly costs, There are a few reasons you may want to recognize what your regular monthly insurance price would certainly be.

Having the best information in hand can make it simpler to obtain a precise car insurance coverage quote. You'll wish to have: Your vehicle driver's certificate number Your lorry recognition number (VIN) The physical address where your vehicle will be kept You might also want to do a little research on the sorts of insurance coverages readily available to you.

Provided listed below are various other points you can do to lower your insurance coverage costs. Shop around Rates vary from business to company, so it pays to shop about. Your state insurance coverage division may additionally give contrasts of rates charged by significant insurance companies.

It's important to select a company that is financially steady. Obtain quotes from different kinds of insurance firms. These companies have the same name as the insurance coverage firm.

Do not go shopping by cost alone. Call your state insurance policy department to find out whether they provide info on consumer issues by company. Choose a representative or business representative that takes the time to address your questions.

Some Of How Much Is Car Insurance Per Month In 2022? Get Car ...

car insurance cheapest car insurance insure cheapest car

car insurance cheapest car insurance insure cheapest car

Prior to you acquire a vehicle, contrast insurance coverage costs Prior to you acquire a new or used auto, examine right into insurance policy prices. Vehicle insurance policy costs are based in component on the car's price, the cost to repair it, its total safety and security record and also the likelihood of burglary.

Review your protection at revival time to make certain your insurance policy demands have not altered. 5. Buy your house owners and also automobile coverage from the very same insurance firm Lots of insurance firms will certainly provide you a break if you acquire 2 or more kinds of insurance coverage. You might likewise obtain a reduction if you have greater than one vehicle guaranteed with the same business.

Ask concerning team insurance Some firms offer reductions to motorists that get insurance coverage via a group strategy from their employers, via expert, business and also alumni teams or from other organizations. cheaper cars. Ask your employer and inquire with groups or clubs you are a member of to see if this is possible.

Choose various other discounts Companies supply price cuts to insurance policy holders that have not had any accidents or relocating violations for a number of years. You might additionally get a discount if you take a defensive driving course. If there is a young driver on the policy that is a great pupil, has actually taken a chauffeurs education and learning program or is away at university without a cars and truck, you may additionally receive a reduced price. insurance.

The essential to savings is not the price cuts, however the last price - insurance companies. A business that provides couple of discount rates may still have a lower overall price. Federal Person Details Facility National Consumers League Cooperative State Study, Education, and Extension Solution, USDA.

The Cheapest Car Insurance For College Students - The Facts

low cost auto cars cheaper cars suvs

low cost auto cars cheaper cars suvs

Usually auto insurer will charge extra for more youthful motorists and also give reduced rates for older vehicle drivers. Insurance coverage carriers see young motorists as inexperienced and also have a better danger of obtaining in accident. In Texas, the typical teen driver in between the age of 16 and 19 will certainly pay $279. 82 per month while a motorist in their 40s will pay approximately $133.

74 Rent $136. 38 Usually, vehicle drivers who currently have car insurance policy coverage will certainly get a less expensive month-to-month price than chauffeurs who do not. Because automobile insurance coverage is a demand in all 50 states, business may wonder about why you do not presently have insurance coverage. Due to this, they might see you as a greater danger motorist.

35 per month. Insurance coverage, Avg regular monthly price Full Protection $138. 35 Obligation Just $91. vehicle insurance. 13 The stats detailed on this web page are from our very own in house reporting. We track and record quotes that providers have provided based upon various criteria. The prices and also standards revealed on this page needs to just be made use of as a quote.

Typical Vehicle Insurance Coverage Rates by Coverage Degree When it pertains to shielding your car, we comprehend that every person's requirements are various. That's why we provide different kinds of automobile insurance policy coverage. Having complete coverage helps you remain secure on the road. This is additionally one of the reasons the average cost of auto insurance policy ranges customers.

A plan that will certainly pay for property problems up to $50,000 will certainly have a greater costs than one that just pays for fixings up to $25,000. Ordinary Automobile Insurance Coverage Rates by Age Your car insurance rates will additionally differ based on your age group.

Indicators on Huntington Bank: Online Banking, Insurance, Investing, Loans ... You Should Know

On top of this, cars and truck insurance is commonly much more pricey for males than women. 3 The longer you have actually been driving and also the older you obtain, the less expensive car insurance policy prices tend to be. Average Cars And Truck Insurance Policy Prices by State The ordinary auto insurance coverage rate by state varies (credit score). According to the Insurance Policy Info Institute (III), Iowa has a few of the most affordable car insurance coverage in the nation at $674, while Louisiana had some of the most pricey at $1,443.

At What Age Is Automobile Insurance Coverage Cheapest? 5 That implies as a motorist obtains older and obtains more experience on the road, their rates will likely decrease.

Which Age Team Pays the Many for Vehicle Insurance policy? Because 1984, The Hartford has aided virtually 40 million AARP members obtain the car insurance coverage they require through special benefits as well as discount rates What State Has the Most affordable typical automobile insurance coverage prices? According to III, in 2017, these states had some of the lowest auto insurance coverage prices:8 To find out much more, obtain a quote from us today.

They'll aid you get the auto policies you require, whether it's to aid spend for damages after a mishap or to shield you from collisions with uninsured vehicle drivers.

Auto insurance policy is necessary to protect you monetarily when behind the wheel.!? Below are 15 approaches for saving on vehicle insurance policy prices.

Medi-cal Eligibility & Covered California - Faq's - Dhcs Can Be Fun For Anyone

Reduced vehicle insurance policy rates might also be available if you have various other insurance plan with the same company. Preserving a Take a look at the site here risk-free driving record is crucial to obtaining lower cars and truck insurance coverage rates (liability). Exactly How Much Does Automobile Insurance Price? Auto insurance coverage prices are different for each vehicle driver, depending on the state they live in, their choice of insurer and also the kind of insurance coverage they have.

The numbers are relatively close together, recommending that as you budget plan for a new auto purchase you might need to include $100 or so each month for vehicle insurance. Note While some points that influence car insurance policy prices-- such as your driving history-- are within your control others, prices may also be affected by points like state policies and state crash prices. insured car.

When you understand just how much is car insurance for you, you can put some or every one of these tactics t job. 1 - perks. Make Use Of Multi-Car Discounts If you get a quote from an automobile insurer to guarantee a single automobile, you could end up with a higher quote per lorry than if you asked about insuring numerous vehicle drivers or cars with that said firm.

If your youngster's grades are a B average or over or if they place in the leading 20% of the class, you may be able to get a excellent student discount on the coverage, which normally lasts till your youngster transforms 25. These discount rates can vary from as little as 1% to as high as 39%, so make certain to reveal proof to your insurance coverage agent that your teen is an excellent student.

Allstate, for instance, provides a 10% car insurance price cut and a 25% property owners insurance coverage price cut when you bundle them together, so check to see if such discounts are offered and appropriate. Pay Interest on the Road In various other words, be a risk-free driver.

The Single Strategy To Use For Best Car Insurance For College Students - The Drive

Travelers uses risk-free chauffeur discount rates of between 10% and 23%, depending on your driving record. For those unaware, factors are typically assessed to a vehicle driver for moving offenses, and more points can lead to greater insurance coverage costs (all else being equivalent).

cheapest insured car cheapest car insurance cheapest auto insurance

cheapest insured car cheapest car insurance cheapest auto insurance

See to it to ask your agent/insurance business about this price cut prior to you enroll in a course. Nevertheless, it is very important that the initiative being used up as well as the price of the course translate right into a huge sufficient insurance coverage cost savings. It's likewise vital that the driver authorize up for a recognized training course.

, think about going shopping around as well as getting quotes from competing companies. Every year or 2 it probably makes sense to obtain quotes from other business, simply in situation there is a lower rate out there.

What good is a policy if the company doesn't have the wherewithal to pay an insurance policy claim? To run a check on a particular insurance company, take into consideration inspecting out a site that ranks the economic stamina of insurance companies.

laws low cost car insurance vehicle

laws low cost car insurance vehicle

In general, the less miles you drive your car per year, the lower your insurance coverage rate is likely to be, so constantly ask concerning a business's mileage limits (dui). Use Mass Transit When you sign up for insurance, the company will typically start with a questionnaire.

The 30-Second Trick For Factors That May Affect Your Car Insurance Premium - Allstate

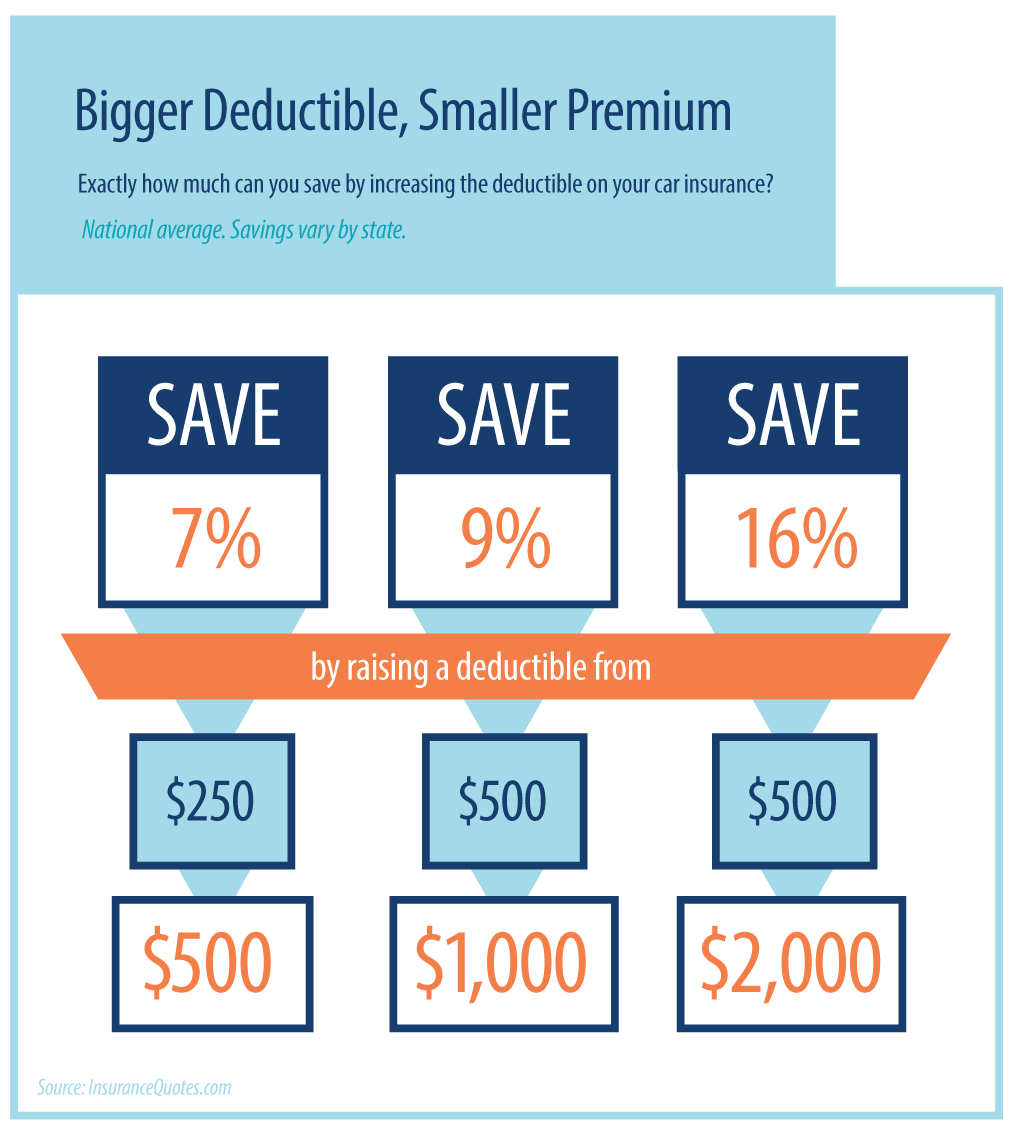

Find out the precise rates to insure the various vehicles you're considering before making a purchase., which is the amount of cash you would have to pay before insurance coverage chooses up the tab in the event of an accident, theft, or various other kinds of damages to the lorry - insured car.

8. Improve Your Credit rating Rating A vehicle driver's record is obviously a big consider establishing automobile insurance coverage costs. It makes sense that a driver who has been in a lot of accidents could cost the insurance business a great deal of cash. However, individuals are sometimes stunned to find that insurance coverage firms might also take into consideration credit report scores when establishing insurance coverage costs.

It's a controversial problem in certain statehouses ... [] insurers will certainly say their research studies show that if you're liable in your individual life, you're much less likely to file claims." No matter whether that holds true, know that your debt ranking can be a factor in figuring insurance coverage premiums, and do your utmost to maintain it high.